Under BJP Modi rule Adani become 3rd richest man and noe become world’s 15th reaches man

Adani is a conglomerate company based in India. It was founded in 1988 by Gautam Adani and is headquartered in Ahmedabad, Gujarat. The company operates in several sectors, including ports and logistics, agribusiness, energy, real estate, financial services, and defense. Adani is one of India’s largest companies and has been involved in several controversies, including allegations of environmental violations, corruption, and labor issues.

I’m not aware of Adani’s business being destroyed. As of my knowledge cut-off in 2021, Adani Group remains one of India’s largest and most influential companies, with interests and operations in several countries. Adani has faced legal and regulatory challenges in the past, but these have not significantly impacted the overall performance and growth of the company. It’s possible that you may be referring to a specific event or situation that had a temporary impact on Adani’s business, but without more specific information, I cannot provide an accurate response.

It’s difficult to determine a specific ranking or position for Adani as a company, as this can depend on various factors and metrics, such as revenue, profit, market capitalization, brand value, or number of employees. However, as one of India’s largest conglomerates with a presence in several countries, Adani is considered to be a major player in the global business landscape. According to Forbes, as of 2021, Gautam Adani, the founder and chairman of Adani Group, was ranked as the 12th richest person in India and had a net worth of approximately $80 billion.

Adani Group, one of India’s largest conglomerates, has been making headlines in recent years for its rapid growth and expansion into various sectors, including ports and logistics, energy, real estate, and defense. However, the company has also faced numerous controversies and criticism over its practices and operations. In this article, we take a closer look at Adani and the findings of Hindenburg Research, a financial research firm that has been critical of the company’s business dealings and financial reporting.

Adani Group was founded by Gautam Adani in 1988 and is headquartered in Ahmedabad, Gujarat. Over the past few decades, the company has grown into one of India’s largest and most influential corporations, with interests and operations in several countries. Adani has been praised for its ambitious projects and investments, but it has also been the subject of intense scrutiny over its environmental and labor practices, as well as its political connections.

Hindenburg Research, a financial research firm, has been a vocal critic of Adani’s business dealings and financial reporting. In recent reports, Hindenburg has raised several concerns about Adani, including allegations of environmental violations, corruption, and labor abuses. Hindenburg has also accused Adani of overstating its revenues and profits, and has questioned the company’s relationships with regulators and government officials.

Adani has vehemently denied these allegations, and has criticized Hindenburg’s research as inaccurate and biased. The company has also taken legal action against Hindenburg, alleging that the research firm’s findings are defamatory and intended to harm Adani’s reputation.

Despite these controversies, Adani has continued to grow and expand, and it remains one of India’s most influential companies. However, the findings of Hindenburg Research have cast a critical light on Adani’s business practices, and have raised important questions about the company’s financial reporting and operations.

In conclusion, Adani Group is a major player in the global business landscape, with interests and operations in several countries. However, the findings of Hindenburg Research have raised important questions about the company’s business dealings and financial reporting, and have sparked a critical examination of Adani’s practices and operations. As Adani continues to grow and expand, it will be important to closely monitor the company’s actions and ensure that they are in line with global standards for ethical and responsible business practices.

In recent years, Adani has been rapidly expanding into new sectors, such as defense and aerospace, and has been making significant investments in these areas. Adani has also been awarded several major contracts by the Indian government, including a $1 billion deal to manufacture fighter jets in India. The company has also been investing in renewable energy, and has announced plans to develop solar and wind power projects in several countries.

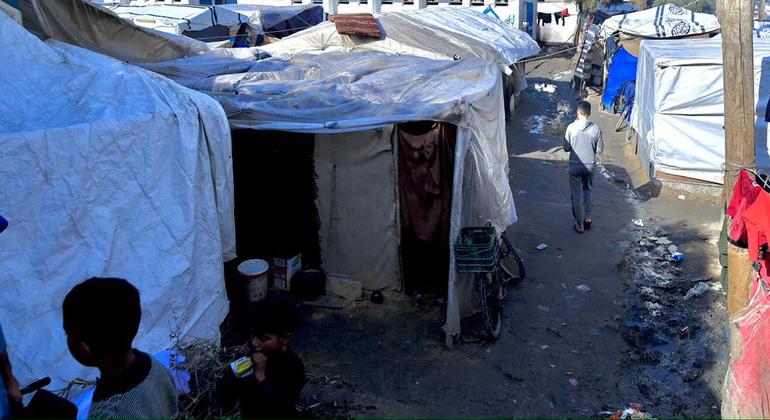

Despite these investments, Adani has faced opposition from environmental groups and local communities, who have raised concerns about the company’s impact on the environment and local livelihoods. Adani has been accused of environmental violations, such as illegally clearing forests and wetlands, and of neglecting the rights of local communities.

Adani’s Political Connections

Adani has been criticized for its close ties to the Indian government and to political leaders. The company has been accused of using its political connections to influence government decisions and to secure favorable treatment from regulators. Adani has also been linked to corruption scandals, and has been accused of bribery and influence peddling.

Adani has denied these allegations and has claimed that it operates in a transparent and ethical manner. However, the findings of Hindenburg Research have raised important questions about Adani’s business practices, and have sparked a critical examination of the company’s political connections and dealings with regulators.

In conclusion, Adani Group is a major player in the global business landscape, with interests and operations in several countries. The company has been praised for its ambitious projects and investments, but it has also been the subject of intense scrutiny over its environmental and labor practices, as well as its political connections. The findings of Hindenburg Research have raised important questions about Adani’s business dealings and financial reporting, and have sparked a critical examination of the company’s practices and operations. As Adani continues to grow and expand, it will be important to closely monitor the company’s actions and ensure that they are in line with global standards for ethical and responsible business practices.

The effect of Hindenburg Research’s findings on Adani Group can be significant, as it has raised questions about the company’s business dealings and financial reporting. The research has sparked a critical examination of Adani’s practices and operations, and has led to increased scrutiny from regulators, investors, and the public.

The findings have also had a negative impact on Adani’s reputation, as the company has been criticized for its environmental and labor practices, as well as its political connections. The findings may also lead to regulatory action and legal challenges, which could impact the company’s future growth and operations.

However, Adani has denied the allegations made by Hindenburg Research, and has stated that it operates in a transparent and ethical manner. The company has claimed that the research was politically motivated and that its findings were not based on accurate information.

Overall, the impact of Hindenburg Research’s findings on Adani Group will depend on how the company responds to the allegations and how the public, regulators, and investors react to the findings. It is important to note that the company has a significant global presence, and the findings may have different impacts in different countries and regions.

Adani’s Response to the Findings

In response to the findings of Hindenburg Research, Adani has stated that the research was politically motivated and that its findings were not based on accurate information. The company has denied the allegations of environmental violations, corruption, and unethical business practices, and has claimed that it operates in a transparent and ethical manner.

Adani has also taken steps to defend its reputation and to address the concerns raised by the findings. The company has issued public statements and has engaged in media campaigns to counter the allegations. Adani has also hired legal and public relations firms to defend its reputation and to respond to the allegations.

The Future of Adani

The future of Adani Group will depend on a number of factors, including the company’s response to the findings of Hindenburg Research and other criticisms, as well as its ability to secure major contracts and investments in new sectors. Adani’s future will also depend on the actions of regulators and the public, who will play a critical role in shaping the company’s future growth and operations.

Despite the controversies and criticisms, Adani remains a major player in the global business landscape, with significant interests and operations in several countries. The company has a large and diverse portfolio of projects and investments, and has been praised for its ambitious plans and investments in new sectors, such as defense and aerospace, and renewable energy.

Conclusion

In conclusion, Adani Group is a major player in the global business landscape, with interests and operations in several countries. Despite its rapid growth and expansion, the company has faced numerous controversies and criticisms, including those raised by Hindenburg Research. The findings of the research have raised important questions about Adani’s business dealings and financial reporting, as well as its impact on the environment and local communities. The future of Adani will depend on how the company responds to these criticisms and how it continues to grow and expand in the future

Adani Group is a privately owned conglomerate, and its ownership structure is not publicly disclosed. However, the company has received investments from a number of financial institutions and banks, including some of the largest banks in India and abroad.

In recent years, Adani Group has also attracted a number of high-profile investors, including sovereign wealth funds, pension funds, and private equity firms. Some of the largest investors in Adani Group include:

- Abu Dhabi Investment Authority (ADIA)

- GIC, a sovereign wealth fund based in Singapore

- Blackstone Group, an American private equity firm

- Brookfield Asset Management, a Canadian asset management company

It is important to note that the investment portfolio of Adani Group is constantly changing, and new investors may enter or exit the company at any time. As such, the above list may not be comprehensive or up-to-date.

Adani Group is one of India’s largest conglomerates, with interests in ports, logistics, agribusiness, defense, aerospace, and renewable energy. The company has rapidly expanded its operations and investments in recent years, and has become one of the largest and most influential businesses in India and the Asia-Pacific region.

Adani’s portfolio of projects and investments is diverse and includes several large-scale infrastructure and energy projects, such as the Mundra Port and Special Economic Zone, the Adani Green Energy Limited, and the Adani Defense and Aerospace. The company has also recently invested in new sectors, such as data centers and electric vehicles, and has announced plans to expand into new markets, such as Australia and the United States.

Adani’s rapid growth and expansion have attracted the attention of a number of large investors, including sovereign wealth funds, pension funds, and private equity firms. These investors have seen Adani as a way to gain exposure to the rapidly growing Indian economy, as well as to the company’s diverse portfolio of projects and investments.

Adani has also received support from a number of government agencies and institutions, including the Ministry of Defense, the Ministry of Civil Aviation, and the Ministry of Shipping. The company has also secured a number of large contracts and investments from the Indian government, which has helped to support its growth and expansion.

Overall, Adani Group has become one of India’s largest and most influential businesses, attracting the attention of a number of large investors and government institutions. The company’s diverse portfolio of projects and investments, as well as its ambitious plans for growth and expansion, make it an attractive investment opportunity for many investors.